Step by step instructions for purchasing

We offer a free consultation to understand our client’s wishes in order to generate a plan of action for funding and an outline of necessary expenses

- Usage (investment · primary residence) confirmation

- Funding plan (your budget and financing options)

- Necessary expenses

- Required documents

- Explanation of pluses and minuses of the purchase

- Explanation of the current New York real estate market

- Selection of properties suitable to your needs from a huge database of listings

- Legal professionals & accountants & architects and other experts as required

Once the consultation is completed, we can proceed to the next step.

We shall provide you with listings based on your requests.

During the showing, we shall give you easy-to-understand explanations about the finer points of the property and provide information on the pluses and minuses of making the purchase.

Introduction points:

- Floor plan · Sunlight availability · Orientation of rooms · Views · Storage · Noise · Floor condition · water · repair spots etc.

⇒If you like sunshine and views, it is imperative to ensure that there are no plans for future skyscrapers to be built in front of the building in the future - Amenities (Doorman · Gym · Pool · Laundry · Garden · Roof Top · Parking,etc.)

- Access to Public Transportation

- Security

- The future of the neighborhood

- Vacancy rate of surrounding properties

- Expected rent

- Management fee · Real estate tax · Repair cost confirmation

- For furniture, move the furniture before the offer and check the wall and floor condition.

Step 3 Offer (purchase application) (click to confirm details)

We also include the negotiation of the terms and conditions in the offer. Also, we shall investigate the latest trading value of similar surrounding properties and inform you on the market price.

▶Important!

Contents of negotiation at the time of purchase of property: price · closing date · mortgage special contracts · repairs

Mortgage Contingency: The right for a buyer to terminate a contract without penalty if the loan is not authorized within a certain period of time. Make sure that this clause is included in the contract.

Step 4 Contract (click to confirm details)

Generally, a 10% deposit (contract money) is required at the time of the conctact.

Checklist:

- Financial condition of the property

- Ownership check

- Information Disclosure (Seller confirms documents that clearly reveal facts of the property stipulated by law to buyer + confirm if mortgage setting, taxes, administrative expenses have been paid)

- Home Inspection (Property Survey, Geological Survey, Termite Study, Dangerous Goods / Hazardous Area Survey etc)

Step 5 Loan application (1 to 2 months) (Click to confirm details)

Preparation of Pre-Approval in advance can shorten procedure.

Step 6 Board approval from condominium management association (click to confirm details)

Application to move in. It takes 2 weeks to 4 weeks.

Step 7 Last inspection of the property (closing day) (click to confirm details)

Allows us to firmly confirm the final inspection of property before closing

- Check for appliance malfunctions such as water, refrigerator, air conditioner etc.

- When a repair is required, determine who covers the repair costs and confirm the duration of repair time.

- If the property is furnished, move the furniture and check the condition of the walls and floors.

Bring:

- Lamp (for checking outlet)

Step 8 Closing (Click to confirm details)

Completed trading procedure! Thank you for your hard work.

- Seller / buyer

- Seller / buyer’s lawyer

- Seller / buyer’s broker

- Lawyers from banks

- Title Company

※ Seller / buyer, if you can not come to closing, prepare a power of attorney document that has been notarized in advance (Notary Public).

In that case of repairs, it is necessary to talk about payment of newly found repair issues at the final inspection. Always be sure to be able to be contacted by telephone during the closing time.

Bring:

- Identification card in English with photo (must have the same name as the contract)

- Cash to be paid to the title company $ 200 to $ 300 (tips)

- Check

- Fire insurance policy

- LLC Book (when purchased by a corporation)

Amount of time required from the establishment of the contract to the transfer of ownership:

- For cash: 3-6 weeks

- For loan use: 1 to 2 months

※ We will coordinate real estate lawyers, accountants, mortgage brokers and real estate appraisers.

Why invest in New York? 10 reasons

1.Market price growth

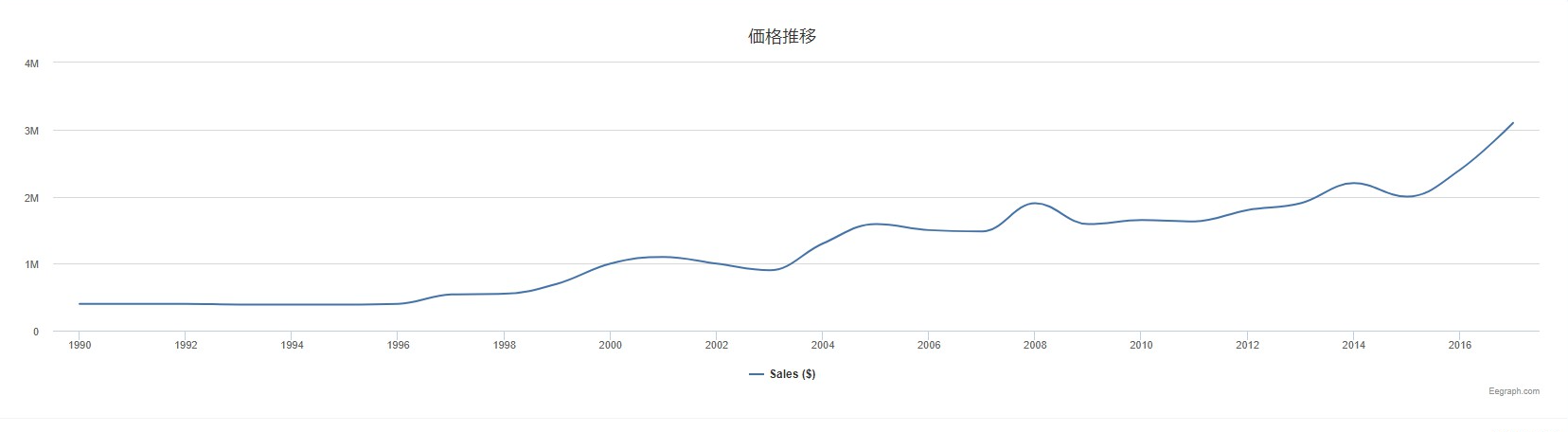

Capital gain: People and money gather in New York from all over the world. New York property has seen a continued a moderate rise for many years. In the past, due to disasters and the financial crisis, property prices dropped by about 10%, but prices have returned to their previous levels and have continued to gradually rise since.

Below is the average price graph properties from 1990 to 2017. You can see that it is gently sloping upward.

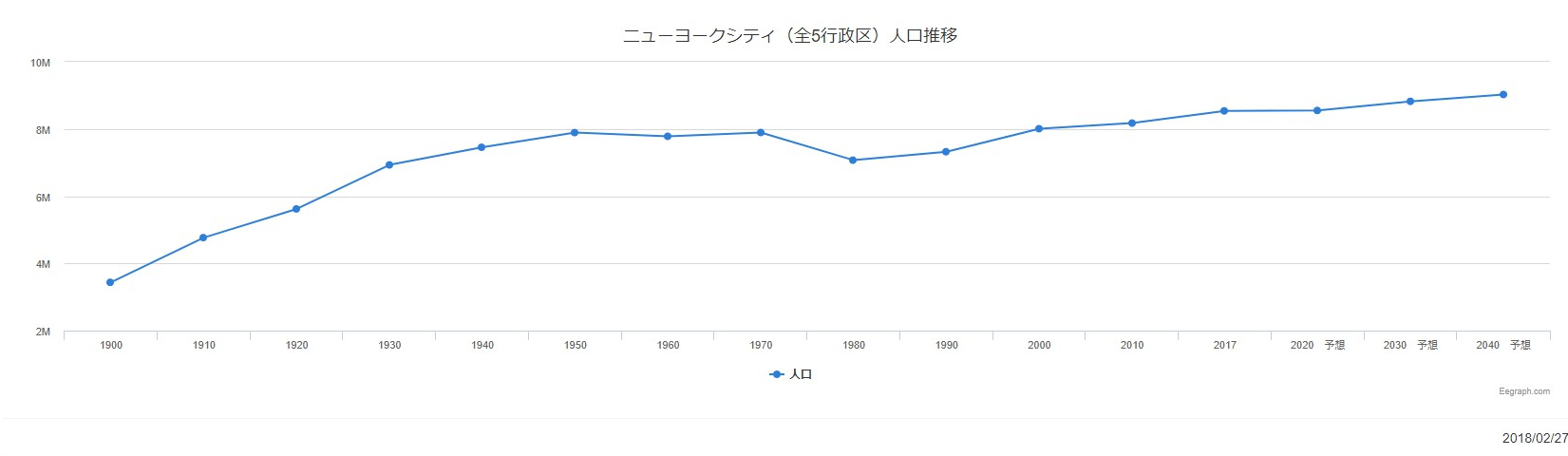

2.Population growth continues in contrast to developed countries

Real estate is location, location, location.

Especially in New York, the risk of declining property prices due to declining population is very small.

3.High liquidity

More than 90% of the entire real estate market is second hand and new construction is less than 10%. Prices will not go down even if it is 2nd hand property, and prices will rise along with the market. Americans will change their houses three times in their lifetime. The second-hand market is also stable. Valuations of used property are high and the market price is stable. Property values are judged by the state of the building, not by the year in which it was built.

4.Transparency of the real estate distribution system

Since the prices are public, there is complete transparency.

The trading of real estate through escrow is very reliable, and there is no fraud.

Escrow is a settlement maintenance system for real estate transactions in which a third-party organization in a fair position acts on behalf of the transfer of ownership to the buyer and keeps the money until the transaction is officially completed.

5.Have a stable property in dollars

Stable earnings can be obtained for a long time.

→ Risk hedge against your currency depreciation

Having foreign currency assets can counter risks against the weak yen.

Example: Purchase of property at 1 dollar 100 yen

$ 500,000 × 100 yen = 50,000,000 yen

If one dollar moves to the yen depreciation of 120 yen …

$ 500,000 × 120 yen = profit of 60,000,000 yen → 10,000,000 yen

6.Depreciation

A new depreciation period starts from the time of purchase.

7.Investor

Investors from outside of the U.S. make up approximately 20% of the total, so foreign ownership will not be affected by 100% of the domestic economy, so relatively stable price movements.

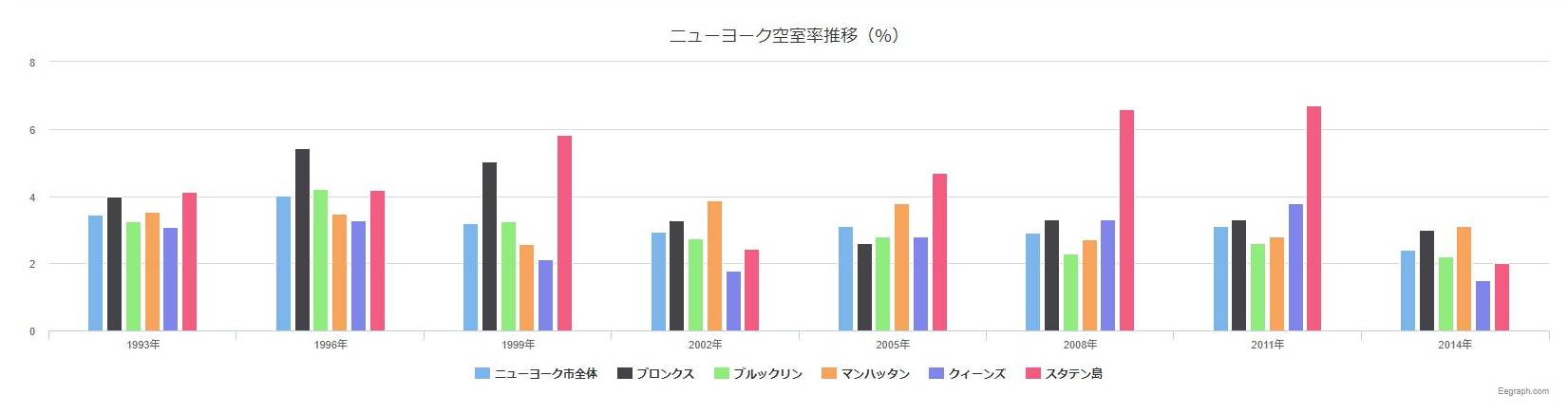

8.Amazing vacancy rates

Vacancy rates are only 2-3% throughout the year. There is little to worry about regading vacancies after the purchase and stable rental income can be expected.

9.Disaster risk

No earthquakes in New York.

10.Status

As the center of the world, New York has a high brand image.

Three benefits of real estate investment in New York

① High tax savings effect

・Depreciation

The value of the building is high, and it is evaluated at the ratio of land 20% and building 80%.

For residential use, the service life is 27.5 years from the point of purchase and 39 for commercial property is applied for both newly construction and pre-owned.

In the case of direct investment from Japan, a substantial tax saving can be attained by total profit and loss.

→ If you apply for 1031Exchange, you replace it to the new property, that has more value than current property, at the end of the depreciation, you can grow your assets without paying tax.

・421A Tax Abatement

Preferential measures established by New York City to promote property purchase. The period is from 10 to 25 years, but in the case of Manhattan it is basically 10 years.

For the first two years, real estate tax has been set at nearly zero, and then every two years thereafter it will rise by 20% and after 10 years the tax reduction effect will cease.

・Capital gain tax incentive

It is applied when holding property for more than 5 years and using it as a residence for 2 years or more.

$ 250,000 per person

Couple $ 500,000

There is income tax deduction. In case

・1031 exchange

Tax deferral measures related to real estate sales gain. Long-term ownership for more than a year can defer taxes of 15% federal tax + state tax + city tax approximately 35%.

1031 Exchange conditions:

– For investment purpose.

– Designate “Like-Kind” replacement item within 45 days of the property to be sold and complete the closing within 180 days.

– 1031 can be used many times.

– Investment property can be located anywhere in the United States.

– If the purchased property is cheaper, tax will be incurred on the difference.

② Income gain

In New York, where the rent is high and the vacancy rate is very low, stable rental income can be obtained even if we subtract administrative expenses etc.

③ Capital gain

Property prices continue to rise moderately and the possibility that the gradual rise will continue in the future is very high in New York where concern about depopulation is minimal.

Particularly in the newly developed district of Brooklyn / Queens, there are also areas where the price has risen extremely quickly in recent years.

Two disadvantages of a real estate investment in New York

① Low Yield

Probable yields in the popular Manhattan area are as low as 2 to 3%, which is unsuitable for investors seeking profits in the short term.

In the suburbs, there are also areas with a high expected yield.

② Foreign exchange risk

As a result of currency fluctuations, asset diminution may occur when converting to Japanese yen.

When making a final tax return in Japan, it is calculated at the exchange rate at the time of purchase, at the time of sale, and the difference is calculated as transfer income (capital gain).

・Preparation

Real estate transactions are smooth if you are prepared in advance.

Necessary expenses:

Cash buyer :approximately 3% of the purchase price.

Mortgage financing: approximately 6% of the purchase price.

Closing cost for Condominium Apartment (Approximate estimate)

| Cash | Attoney Fee | $2,000~$3,000 |

| Offering Plan | $100~300 | |

| Credit check Fee | $50~150 | |

| Title Insurance & Search | About $ 700 per $100K | |

| Filing Fee | $300 | |

| CC & RET Adjustment & Insurance | Start from closing date | |

| Application Fee | $1,000~2,000 | |

| Move-in Deposit refundable | $500~$1,000 | |

| Move-in fee non refundable | $250~$1,000 | |

| Additional fees for more than $ 1,000,000 properties | Mansion Tax | 1% of purchase price |

| Mortgage | Attorney Fee for bank | $700~$1,200 |

| Handling Charge for bank | 0 ~2% of loan amount | |

| Mortgage Tax | 1.80% for loan amount less than $ 500K, 1.925% for $ 500K or more | |

| Mortgage Title Insuracne | $500 | |

| Application Fee for mortgage | $500~1,000 | |

| UCC-1 Filing | $300 | |

| Appraisal Fee | $500 | |

| Sponsor unit (Additional) | Transfer Tax (State) | $4 per $1,000 (0.4%) |

| Transfer Tax (City) | 1% for the property price less than $ 500K, 1.425% for over $ 500K. | |

| Attorney Fee | $ 3,000~$4,000 | |

| Common Charge | $2,000~$3,000 |

Required Documents (For everyone who signs the contract · English translation required)

• W2 Form ⇒ Sample

• Tax Returns past 1-2 years ⇒ Sample

• Pay stub past 3 months

• Employment letter ⇒ Sample

• Financial report ⇒ Sample

• Bank Statement past 1-3 months

• Copy of photo ID

• Reference letter ⇒ Sample1 ・ Sample2 ・ Sample3 ・ Sample4

Documents required by the property are on a case by case basis.

There are also documents that require notarization (Notarize) which is available at the office of a notary public, major banks in the U.S.A. and the American embassy.

・Broker fee

Since the seller pays all of the real estate commission at the time of purchase, there is no broker fee required from a buyer.

For a free consultation please do not hesitate to contact us.